Every accounting practice in the UK is expected by its clients to offer auditing services. To provide the best auditing services to your clients, you will need the assistance of an audit partner, and choosing the right one will make all the difference.

A professional audit firms will enhance your credibility and provide valuable financial insights for your clients. These insights will help you in managing risks, optimising processes, and strengthening client trust. Audit services can help not only with accuracy but also in strategic decision-making.

To help you in choosing the right partner, we have made a list of the top 10 audit firms in the UK. In this blog, we highlight their strengths and how they will support your practice in audit services.

Why the Best Auditing Companies Matter for Your Practice?

Partnering with a professional audit outsourcing services provider offers more than just regulatory compliance; it is a strategic investment for your practice. A reputed audit partner will ensure accurate financial reporting while delivering valuable insights that help your firm in maintaining client trust and compliance with the latest regulations.

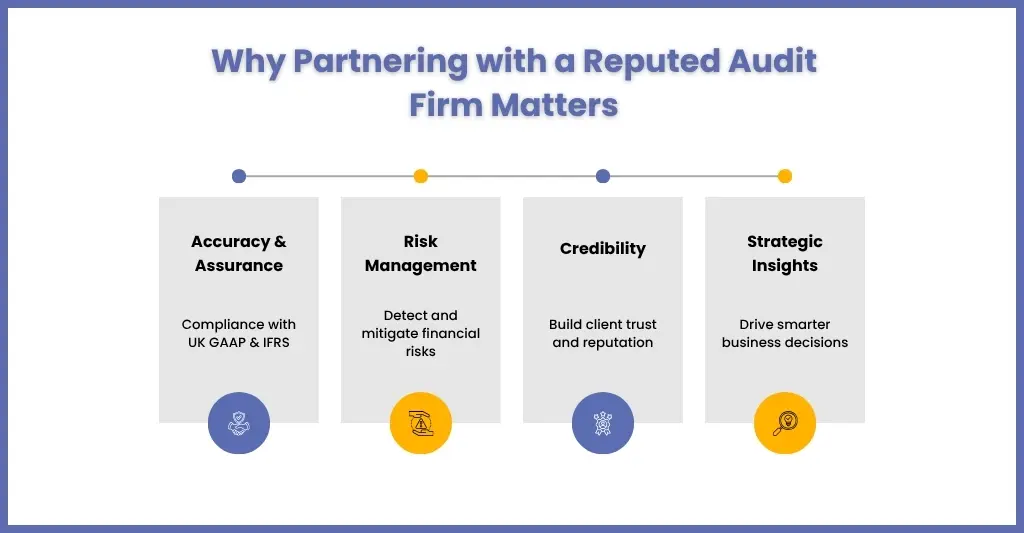

Here’s why working with the best auditing companies matters:

Accuracy and Assurance

Top audit providers will ensure your clients’ financial statements are error-free and compliant with the latest UK GAAP and IFRS standards. They will identify errors, discrepancies, and frauds beforehand, thus preventing costly and regulatory penalties. An accurate audit report will give confidence to your clients.

Risk Management

Auditing is not just confined to numbers; it’s also about highlighting and resolving financial, operational, and compliance risks. A skilled audit provider will swiftly identify the weakness in internal controls, uncover fraud, and provide solutions to rectify the process, thus safeguarding your practice and your client’s interests.

Credibility

By partnering with a credible audit service provider, you will be enhancing your practice’s credibility. Your clients will be assured that their finances will be verified independently and managed as per the highest standard. Such credibility will help you attract new clients and retain existing ones.

Strategic Insights

Apart from compliance, a professional audit firm will also provide you with high-value advisory services. These services include analysing financial performance, identifying trends, and providing high-value insights. These services enable you to optimise operations, improve profitability, and make informed strategic decisions. Such guidance will help you to evolve into a high-value advisor for your clients.

Top 10 Audit Firms in the UK – Leaders in Financial Assurance

Right now, the UK accounting market is filled with audit providers offering auditing services to numerous accounting firms. However, we have listed a few good ones that will generate confidence in your clients and the reputation of your practice. These audit providers are:

1. Corient Business Solutions

Corient is a professional accounting service provider offering auditing services to accounting practices in the UK. Since 2011, we have made our name by offering end-to-end audit support from statutory audits and compliance checks to financial advisory.

We emphasise combining advanced technology, such as AI, with qualified auditing professionals to provide accurate, efficient, and actionable insights. Our scalable and GDPR and ISO 27001-compliant solutions will allow you to handle complex audits without compromising on quality standards.

Along with audit services, we offer:

- Year End Accounts Outsourcing

- Bookkeeping Outsourcing

- Payroll Outsourcing

- Management Accounts Outsourcing

- Offshoring Services

- Corporation Tax Outsourcing

- VAT Outsourcing

- Making Tax Digital

- Advisory And Consulting Services

2. David Howard

They believe in producing and auditing accounts as quickly as possible so they can be used for decision-making while they are still relevant.

3. Audit Board

Offers single window visibility and minimises redundancies, thus future-proofing investments.

4. IRIS

It can deliver financial auditing services tailored to your firm and provide support through all audit stages, from planning to execution and reporting.

5. Forvis Mazars

Their audit work delivers insight and promotes transparency, building confidence among stakeholders.

6. Acobloom

Its auditors have expertise in reviewing financial statements, preparing a summary of audit differences, maintaining disclosures, and preparing audit working paper files, which can be easily passed on to us.

7. Diamond Outsourcing Limited

Their auditors will handle routine number crunching and paperwork, working as per your decided timetable and applying the audit tests you’ve specified.

8. Gravita

The audit services are designed to be streamlined for efficiency, with no compromise on the deadlines and quality of the audit.

9. Blick Rothenberg

The company has invested in a technically sound and agile audit, assurance and advisory practice that services a wide cross-section of clients.

10. Moore UK

Moore UK offers audit services to all sizes with a local, personal approach.

How to Choose the Right Audit Firm for Your Practice

Getting the right audit partner will be one of your critical decisions for your practice and your clients. By selecting the right firm, you will ensure complete compliance and enhance your service, boosting confidence among your clients. Here’s what to consider when choosing an audit firm:

Industry Experience

While choosing your audit partner, see their experience in auditing for either a specific sector or multiple industries. An audit firm that is familiar with UK accounting standards and your needs will understand the risks, regulations, and reporting requirements. Such knowledge will allow you to provide accurate audits, insights, and recommendations suited to your clients.

Compliance Knowledge

It is ideal to choose an audit firm that regularly monitors regulatory updates related to UK GAAP, IFRS, and HMRC guidelines. An audit firm with complete knowledge of regulations will guide you in maintaining compliance and best-in-class financial reporting standards.

Technology Integration

Professional audit firms are increasingly relying on digital tools to fine-tune their accuracy and efficiency. Therefore, identify firms that use AI, automation, and cloud-based platforms for tasks like data collection, reconciliation, and report generation. These technologies will speed up the audit process and reduce human error, and provide real-time visibility into audit progress, making the process more transparent for your practice.

Scalability

As your client base grows, so will their auditing requirements. Hence, you will need to find an audit firm that can offer scalable services to handle increased volume, multi-entity audits, or additional advisory services. This will ensure a long-term relationship without the need to switch to a new provider.

Client Support

Strong client support is essential for a successful audit relationship. Evaluate the firm’s responsiveness, clarity in reporting, and advisory capabilities. A professional audit partner will always prioritise helping you in financial management and client relationships.

Benefits of Working with Reputed Audit Firms

Reputed audit firms offer multiple benefits for accounting practices in the UK. These benefits range from tangible ones to strategic benefits that will enhance client trust. Here’s a closer look at the benefits:

Accurate and Reliable Financial Statements

Reputed firms will prepare financial statements as per the UK GAAP, IFRS, and HMRC regulations. Accurate statements will save your clients from penalties and give confidence to stakeholders about the information.

Mitigation of Regulatory and Compliance Risks

Professional audit firms are experts in UK regulations and will review and identify non-compliance, discrepancies, and suggest internal controls to protect you and your clients.

Improved Client Confidence and Business Credibility

When your client knows that a reputable audit firm is auditing their accounts, it builds trust in your practice. Such credibility can be used for attracting new clients.

Access to Advanced Reporting and Advisory Insights

Apart from auditing, leading firms will provide strategic insights, such as trends and opportunities, and offer recommendations to optimise operations further.

Time and Cost Savings for Your Practice

Working with a reputable audit firm can streamline internal processes and reduce administrative burdens. Their expertise and efficient workflows mean audits are completed faster and with fewer errors, saving your firm time and money.

People Also Ask

1. Future Trends in Audit Services

a. Increased use of AI and automation for audits

b. Integration of real-time data analytics

c. Growth in outsourced and offshore audit services

d. Emphasis on strategic advisory alongside compliance

2. How do audit firms differ from accounting firms?

Audit firms only focus on verifying the financial statements and its compliance, while an accounting firm will look after day-to-day bookkeeping, financial management, and reporting.

3. What is an audit in the UK?

Audit is professional service in which an auditor gives its opinion on whether the financial statements of an entity is accurate or not.

4. What are the 4 types of audit?

The four types of audits are financial audits, internal audits, compliance audits, and performance audits.

5. Are audit firms also capable of handling advisory services?

Modern audit firms like Corient are increasingly offering advisory services, including risk assessment, business strategy, and financial planning, alongside traditional audit functions.

Conclusion

Choosing the proper audit is a test you cannot fail, as your reliability, efficiency, and strategic insights are at stake. Also, your clients’ trust is at stake, as they will depend on you for advanced, scalable audit solutions to survive in the UK market. That’s why you place your trust in providers like Corient.

Established in 2011, Corient specialises in accounting and audit services. Our outsourced audit support service team streamlines the auditing process, alleviating auditors of the burden of time, expenses, and workforce. We have a team of highly trained, qualified, and experienced professional auditors dedicated to processing audit working papers.

Are you in need of streamlining your auditing services? Connect with us and book a free trial of our services.