In double-entry bookkeeping, every transaction is entered as either debit or credit, and the purpose of the trial balance is to ensure that all the debit balances match the total credit balances. Trial balance plays an important role in the accounting cycle, especially before preparing financial statements.

Trial balance is the method by which accountants, accounting practices, and business owners verify the accuracy of bookkeeping entries and single out potential errors committed during the accounting period. It contains the figures from the profit and loss statement and balance sheet.

In this blog, we will discuss in detail its importance, format, and preparation. However, if you are interested in learning more about double-entry bookkeeping, please read our beginner’s guide.

Preparing a Trial Balance Report

Currently, most accounting software has been incorporated in its report section, and your clients highly prefer it for its accuracy. Xero, FreshBooks, and QuickBooks, to name a few, have incorporated and are quite dependable.

Manual preparation is still around but less preferred because it is prone to human errors. This is why accounting software is becoming increasingly preferred. Accounting outsourcing service providers use this software daily and have gained expertise in them. Therefore, if you prefer, you can outsource the preparation task to a professional and experienced bookkeeping service provider like Corient.

Uses of Trial Balance

Trial balances serve multiple purposes, including the following:

Year-End

Thanks to the trial balance report, accountants, accounting practices, and auditors will be able to see a clear and complete picture of a business at year’s end.

Helping in Making Adjustments

Your accountants depend on trial balance to determine whether any adjustments are required in the financial records. These adjustments range from simple data entry mistakes to more complex discrepancies. Furthermore, the importance of trial balance increases during the year end because multiple adjustments are needed in accounts to reflect the accurate financial position of your client’s business. These year end adjustments include depreciation of fixed assets, writing off bad debt, accruals and prepayments.

Migrating to a New Accounting Software

When switching to new accounting software, you must prepare a report to ensure the figures match. To conduct a smooth transfer, you will need an ideal period, such as the end of the year. This timing allows your clients’ businesses to switch smoothly without causing major disruptions to their operations, allowing them to start operations in the new year with a new accounting system.

The transfer from old to new accounting software is successful only when the old software is executed, and its numbers are added as opening balances in the new software.

What Will the Format of Trial Balance?

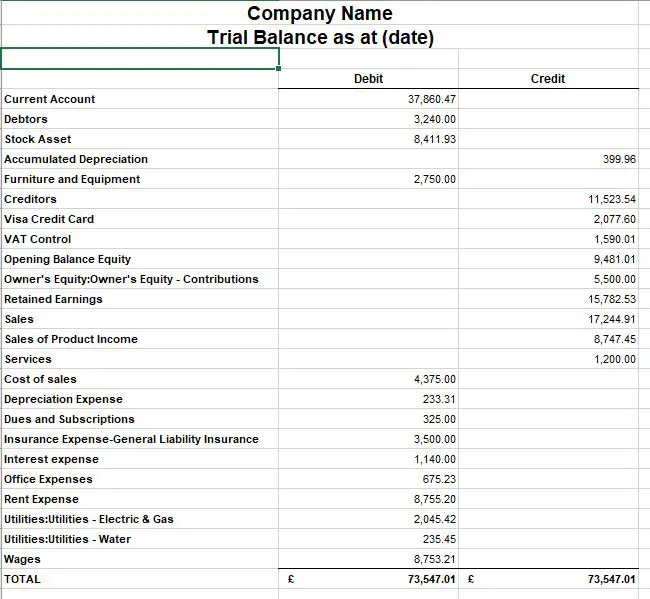

The format will contain the following information:

- Report header: Company Name and date

- Columns: Ledger account codes, if used, and account names, credits and debits amount

- Total of the Debit column and Credit column

All the accounts that comprise the balance sheet (assets, liabilities and Equity) are first followed by the profit and loss accounts (sales and expenses).

Example of a Trial Balance

As you can see in the example below, it will include all the balances from the profit and loss account. The example below is downloaded from QuickBooks in Excel format.

You will require a journal entry if you review and notice that an adjustment is necessary. The journal entry will need a debit and credit. Accounting systems will not accept a journal unless it balances. Looking at this makes it easier to decide what the journal entries are.

Conclusion

In conclusion, the trial balance is an essential tool that helps maintain accuracy in financial statements by detecting errors and discrepancies. It provides a snapshot of your client’s business health for a specific period and helps identify discrepancies. By analysing, you can correct the errors and generate accurate financial reports.

Managing multiple clients can be overwhelming—consider outsourcing tasks like preparation to lighten your workload. Corient, a reputable accounting outsourcing provider, efficiently manages accounting tasks, just as we’ve done for numerous clients. For more details or to discuss your needs, contact us through the form on our website.