A balance sheet is an accounting report that is important for the business of your client’s. The balance sheet lays out in detail the financial position of your client’s business, thus promoting transparency. Using the balance sheet, your clients can see their financial health and take corrective steps if required.

A balance sheet can be shared with stakeholders such as investors, shareholders and lenders so they are updated with the financial status of business and accordingly make their decision. The balance sheet is required to be submitted to Companies House if your clients services companies registered to it.

While most of us have heard about the balance sheet, do you know its internal workings, what it is composed of, how it is prepared, and so on? Maybe not completely. Hence, this guide is for beginners where we have tried to explain the nitty gritty of the balance sheet in the simplest way possible.

What Are the Three Financial Statements?

There are three financial statements which you will have to prepare for your client’s, among them is balance sheet which is used measuring their financial performance. The balance sheet displays your client’s business assets, liabilities, and shareholder equity. The other two financial statements are profit and loss statement and cash flow statement.

Balance sheet enables you to get a quick overview of your client’s business on any given date, especially on year-end or month-end. It is a valuable instrument to know about the value of the assets owned by your client’s. Through the balance sheet you can get vital information, thus giving a clear picture and promoting stability. Using the balance sheet, banks and suppliers can offer loans, overdraft or credit facility.

Profit and Loss Statement

Also, known as income statement discloses your client’s income and expense during the specified period. Through this statement, you can make out whether your client’s are in profit or loss.

Both balance sheets and profit and loss statements are required to understand the financial health of your client’s business, and a review of these reports must be done at regular intervals.

Cash Flow Statement

The cash flow statement is another important financial statement that shows a company’s cash inflows and outflows over a specific period. You can use this report to see how your business is doing overall and whether it has enough cash to cover its expenses.

What is Included in the Balance Sheet?

Inside the balance sheet contains three important aspects asset, liabilities, and shareholder’s equity. Assets are everything that is owned by your client’s business and can be used by them to pay off debts. Liabilities are money that your clients owe to other and shareholder equity is difference between your client’s assets and liabilities. It shows how much of the company belongs to its shareholders.

What are Assets?

Assets can be divided into three sections, i.e., current assets, fixed assets, and intangible assets.

Current Assets

Assets that are owned by your clients and can be easily converted into cash are considered as assets. Under it comes the funds available in the bank, accounts receivable and inventory stock. These assets are vital for maintaining liquidity and meeting your clients short-term goals.

Elaborating more on accounts receivable, it is the amount that is owed by the customers to your clients. Inventory stocks are items that your clients possess with the goal of selling them; under them also come products.

Fixed Assets

Fixed assets are also known as long-term assets and as its name suggest it is for assets that your client’s are planning to use it for the longer term. Land, building, machinery, and vehicles are to be considered as fixed assets.

When your clients buy a fixed asset, it registers this purchase in the balance sheet with its original cost. Your client’s will then depreciate it value over time. It is ideal for your client’s to keep a register for fixed assets, this helps them in keeping a track on the value and conditions of assets. It also plays a crucial role in financial management by making sure depreciation calculations is taken into account.

Intangible Assets

Intangible assets are those that are not in physical form, such as copyrights, patents, or trademarks. These assets are valuable and must be registered in the balance sheet. The price paid for acquiring these assets is known as the original cost. This figure is crucial for accounting purposes, as it serves as the basis for calculating depreciation or amortisation expenses over the asset’s useful life, thereby impacting your client’s financial statements and tax liabilities.

What Are Liabilities?

Liabilities signify the financial duties your clients must fulfil in the future, which includes loans. Liabilities can be divided into current and long-term liabilities.

Current Liabilities

Current liabilities are debts which must be settled within a year. Many of your client’s deal multiple current liabilities that includes accounts payable, deferred revenue, taxes payable, and salaries payable. It is to be noted that active monitoring needs to be done of current liabilities, so that your client’s can be warned if their debts is crossing a certain limit.

Long-Term Liabilities

Long-term liabilities are to be paid over more than a year; this includes money owed on a mortgage or loan and lease payments.

What is Equity

Shareholder equity, also known as owner equity highlights the difference between the client’s assets and liabilities. It showcases how much of your client’s company belong to the shareholders. When you client makes profit, the profit amount is added in the shareholder’s equity. However, when your client loses money then loss is deducted from the shareholder’s equity.

How to Prepare a Monthly Balance Sheet

In the past, your clients or you must have been using excel tool to create the design of the balance sheet but not anymore. These days all businesses and accounting outsourcing service providers use accounting softwares because they come programmed with balance sheet section. Thanks to this section, printing out balance sheet has become a piece of cake.

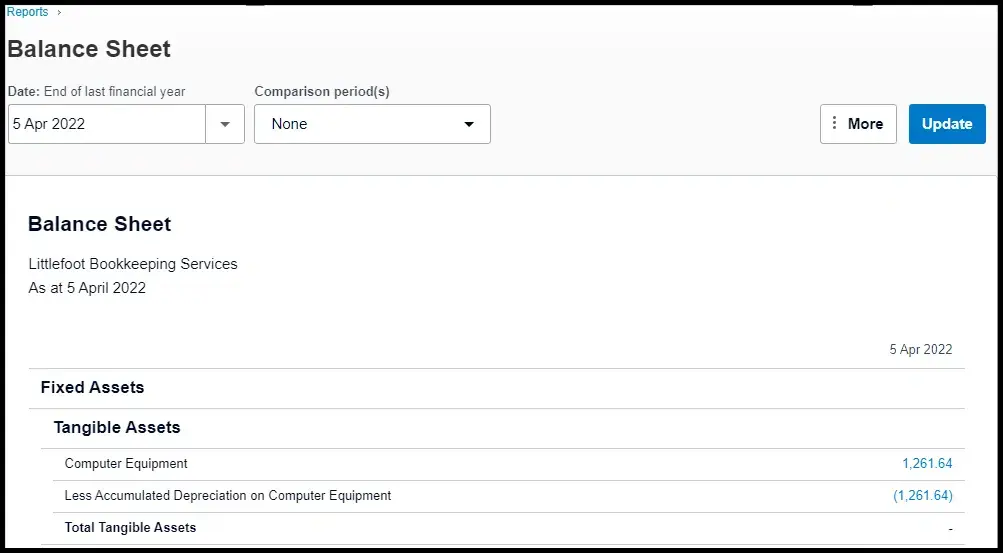

Below are the options in Xero for producing a balance sheet:

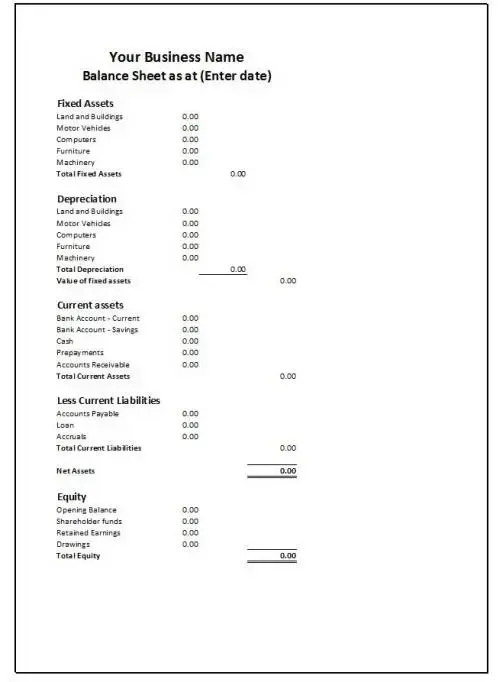

Below is a typical balance sheet example:

Financial Ratios and the Balance Sheet

A balance sheet can be used to calculate several financial ratios, and calculating it is essential for two reasons.

The first reason is to see how well the client is performing by comparing it to previous years’ performance. The second reason is to compare your client’s performance with its competitors. That way, you will get an idea of how much profit your clients are making.

There are multiple financial ratios that can be calculated from the information on a balance sheet. But we will take a look at the two most common ones.

Debt to Equity Ratio

Under this ratio, calculation is done by dividing the total liabilities by the total equity. This gives you a percentage showing how much your clients are financed by debt.

A higher debt-to-equity ratio means your clients relies more on debt to finance its operations. This could signify financial trouble if the debt is not being paid back.

Current Ratio

The current ratio is calculated by dividing the total current assets by the total current liabilities.

This shows how easily your clients can pay their short-term debts. A higher number means your clients are better positioned to do this.

What is a Balance Sheet Used for?

The report gives a quick overview of your client’s business. It shows how much does your client’s owns (assets) and owes (liabilities). This report can be used by your clients to gain bank loans and for maximising investment prospects by sharing it with investors, creditors, and shareholders.

Who Prepares the Balance Sheet?

It can be prepared by accountants employed in your accounting practice or your clients itself. If the balance sheets have to submitted to the Companies House than it is recommended that accountant prepares the balance sheet because they are well-aware of the accounting principles.

Sometime, accounting practices like yours may find themselves overloaded with work of multiple clients at the same time. This may hamper productivity, and increase the chances of error. To avoid such a scenario, you can get the done by outsourcing an accounting service provider such as Corient Business Solutions, which employs professional and experienced accountants.

Conclusion

Balance sheets are of utmost importance because they show the financial position of a business. Hence, its preparation must be done with utmost care to maintain accuracy; after all, based on that, your clients will make decisions and investors will make their investment decisions. The goal of this blog is to explain the balance sheet details so that you do not find any difficulty while preparing it. If you find it difficult to prepare for complex client businesses or get overloaded with sheet work from multiple clients, then don’t stress because Corient is at your service. Our professional and experienced accountants will prepare error-free balance sheets on your behalf and within the deadline. For more information about our services, please visit our website and contact us via the contact form.